Contents

Does USAA offer solar loans?

USAA home loans are great because the cost of the solar system can be included in the total cost of purchasing the home thereby lowering the overall interest rate you will be playing on the solar system over the years.

Who qualifies for USAA loans?

Here are some general guidelines:

- Current active duty members are eligible after 90 days of continuous service during wartime.

- Veterans on duty after August…

- Members of the National Guard and reserves are eligible after 90 days of active service or six years of guard and reserve service.

What credit score do I need to get a personal loan from USAA?

USAA is best for borrowers who: Are current or eligible USAA members. Have good credit (690 FICO or higher).

Is a solar loan worth it?

Whether you choose to buy or rent your solar panels will have a huge impact on the long-term value of your system. If you have enough cash to make the purchase in cash, you’ll save more than any other option – but even with a $0 solar loan, your savings could still run into the tens of thousands.

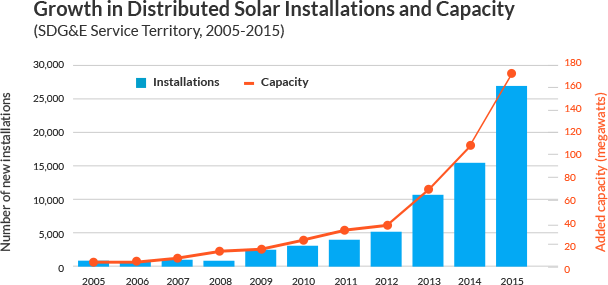

Does SDG&E buy back solar power?

With this tariff structure, SDGE charges different rates for power usage depending on the time of day, hence the name “Usage Time”. They also buy back excess solar power produced by the home solar system at that rate, so solar power is worth more or less depending on the time of production.

Does solar make sense in San Diego?

San Diego topped the list of installed solar energy capacity and second in installed solar energy capacity per capita in major US cities, according to a report from California Environment Research & Policy Center.

How much does it cost to install solar in San Diego?

Given the size of a 5 kilowatt (kW) solar panel system, the average solar installation in San Diego, CA ranges in cost from $12,028 to $16.272, with the average gross price for solar in San Diego, CA coming in at $14,150.

Why is my Sdge gas bill so high?

“And they increased.” So why are the prices so high? One reason is that California’s size and geography increase the “fixed” costs of operating its electrical system, which includes maintenance, generation, transmission, and distribution as well as public programs such as CARE and fire mitigation, according to the study.

What credit score is needed for solar panels?

Other loans for solar panel financing Borrowers must meet certain qualifying requirements, such as a minimum credit score of 660 and a debt-to-income ratio of 45%, to be eligible for this type of solar financing.

What is the monthly payment for solar panels?

The payment for this solar loan – $159 – is about the same as what many people are already paying for electricity each month. A solar panel system that costs $15,000 can offset about 90% of the electricity use for millions of American homeowners. Of course, solar panel loan rates vary based on the credit status of the borrower.

What type of loan is a solar loan?

Similar to a home improvement loan, a homeowner borrows money from a lender, either a bank or a solar company, and then pays it back with interest in monthly installments. This helps homeowners use solar power for $0 while financing the entire system.

What is the best way to pay for solar panels?

There are two ways to pay off your solar panel system directly: upfront payment, cash, and a solar loan. A cash purchase of a solar panel system is the best way to maximize your savings from solar.

Is financing available for solar?

The easiest way to get capital to use solar is through a loan, which can save anywhere from 40% to 70% over the life of your solar panels. … Various sources offer loans, including banks and solar installers. A new type of loan makes solar energy accessible to more people.

Is it harder to sell a house with solar panels?

For most home buyers, solar panels are indeed a selling point. … According to the National Renewable Energy Laboratory, homes with solar panels sell 20% faster and 17% more than those without.

Is a solar loan tax deductible?

Unlike secured loans, interest on unsecured diesel loans is not tax deductible.

Sources :