Contents

Does SDG&E buy back solar power?

With this tariff structure, SDGE charges different prices for electricity use, depending on the time of day, hence the name “Time for use”. They also buy back excess solar energy produced by solar systems in the home based on these prices, so solar energy is more or less worthwhile depending on the time of day it is produced.

How much does it cost to install solar in San Diego?

Given the size of the 5 kilowatt (kW) solar panel system, an average solar installation in San Diego, CA ranges from $ 11,985 to $ 16,215, with an average gross price for solar in San Diego, CA of $ 14,100.

Does Sdge pay you for solar?

SDG & E does not offer solar cells for every homeowner. However, the California Solar Initiative has two discount programs that low-income households in SDG & Es’ service territory may qualify for: Single-Family Affordable Solar Housing (SASH) and Multi-Family Affordable Solar Housing (MASH) programs.

Can you cash out solar credits?

Solar credit form We can either add it to the electricity bill or refund the amount to your designated bank account. If you want a refund, send this completed form to our solar invoicing specialists, and we will refund you via a deposit in your account or send out a check to you.

Is there a California tax credit for solar?

Investment Tax Credit (ITC) provides an amount of 26% of the purchase cost of your solar system to homeowners before 2020. By having a solar energy system installed in 2020, you get a maximum 26% tax deduction in California before going down to 22% in 2021.

Is it worth going solar in California?

The combination of Federal Solar Tax Rabate and retail repurchase rates make solar panels worth it in California, with a payback period of less than 6 years. California has a lot of solar energy available, and it seems to make perfect sense to convert that energy into electric power we can use.

Does California have a solar tax credit 2021?

Buy and install a new solar system in California in 2021, with or without a home battery, then you can qualify for a 26% federal tax deduction. ITC for housing will fall to 22% in 2023 and end in 2024.

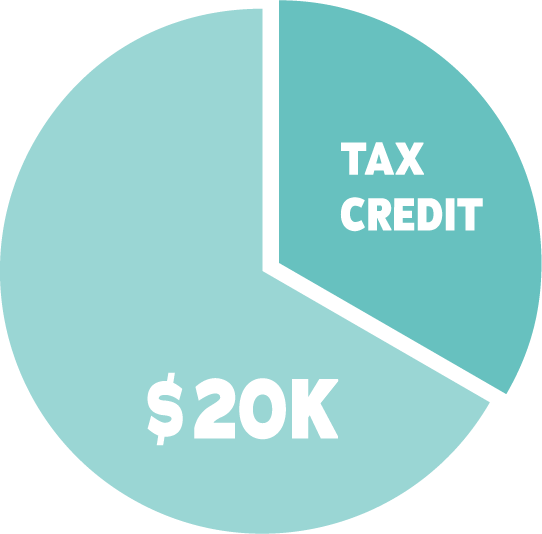

How much is the solar tax credit for 2021?

In 2021, ITC provides a tax deduction of 26% on installation costs, provided that your taxable income is greater than the credit itself. For most homeowners, this effectively translates into a 26% discount on your home solar system.

Is there an income limit for federal solar tax credit?

Is there a maximum income to claim the solar tax deduction? There is no income ceiling on the ITC program. However, you need a tax liability large enough to claim full credit. If you do not, you must transfer the remaining credit to a new year.

How long does a solar tax credit last?

In December 2020, Congress passed an extension of the ITC, which provides a 26% tax deduction for systems installed in 2020-2022, and 22% for systems installed in 2023. (Systems installed before December 31, 2019 were eligible for a 30% tax deduction.) The tax deduction expires from 2024 unless Congress renews it.

Is the solar tax credit a refund?

DO I GET A REFUND? This is a non-refundable tax credit, which means you will not receive a tax refund for the amount of your solar tax deduction that exceeds your tax liability. However, you can transfer an unused amount of the solar tax deduction to the next tax year.

How do I apply for solar tax credit in California?

Claiming ITC is easy. All you have to do is fill out IRS Form 5695, “Residential Energy Credits.” Form 5695 calculates tax deductions for a number of qualified energy improvements for homes, including geothermal heat pumps, solar panels, solar water heating, small wind turbines and fuel cells.

Do I qualify for solar rebate?

There are a few important qualification rules to be eligible for a solar discount on your system: The solar system must be a qualified small-scale photovoltaic system, wind or water system. … The solar solar system must have been installed no more than 12 months before the application date for STC.

Do solar panels last forever?

But the solar panels that generate that power do not last forever. The industry’s standard lifespan is about 25 to 30 years, which means that some panels installed at the beginning of the current boom are not long in coming to retirement.

How do I qualify for a solar ITC?

How do I qualify for the Federal TAX Deduction (ITC)?

- Valid until 31 December 2022 (and falls to 22% from 1 January – 31 December 2023). …

- You must own your house. …

- You must own your solar panels. …

- You must pay enough tax to the federal government to qualify for the 26% tax deduction.

Sources :